Elsewhere in this post

“Sydney and Melbourne’s inner-city apartment glut shows no sign of easing with the clear prospect of high rental vacancies persisting into the foreseeable future,” says Dr Andrew Wilson, Chief Economist at AI property intelligence platform Archistar, “Which is good news for tenants but not so good news for landlords.”

According to the latest data from My Housing Market, there are currently over 23,000 units listed for rent in Sydney and over 20,000 unit vacancies in Melbourne.

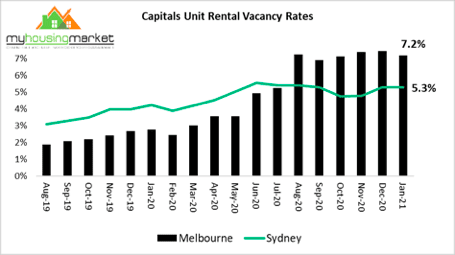

Apartment vacancies in Melbourne and Sydney have soared over the past 18 months, it says in a Press release, initially reflecting a surge in newly completed apartment stock from the recent building boom, and then exacerbated by a sharp fall in demand due to coronavirus control policies closing borders.

Closed borders severely curtailed rental demand from international students with demand for short-term business and tourist accommodation also sharply declining. Numerous short-term accommodation landlords switched to the permanent market in search of tenants, further adding to already saturated supply levels.

Other factors contributing to the supply-demand imbalance included high levels of first home buyers, and economic concerns and lockdowns reducing the normal growth in new local tenancies.

Inner city glut

Inner-city suburbs have contributed overwhelmingly to Melbourne and Sydney’s ongoing apartment rental market glut.

In Melbourne, the City of Melbourne encompassing the CBD, Docklands and Southbank, currently reports over 8,000 vacant units – nearly 40% of Melbourne’s total unit vacancies.

In Sydney, the City and East, and Inner West suburban regions are currently reporting nearly 10,000 vacant apartments or 50% of Sydney’s total.

Sustained record high vacancy rates have predictably resulted in falling rents with the median weekly asking unit rent in Sydney falling from $520 to $450 per week over the past year – a fall of 13.5%. Similarly, Melbourne unit rents are down by 10.5% over the same period – falling from $430 to $385.

Predictably, inner-city suburbs have recorded the sharpest declines over the past year with weekly unit rents in Sydney’s City and East region down from $625 to $450 – a fall of 28.0%. In Melbourne, unit rents in the CBD City area have fallen by 24.5% to $400 a week over the past year.

More Choice

Falling rents are clearly good news for tenants, improving housing affordability and increasing disposable income, with high vacancy rates providing more choice and motivating landlords to provide higher-quality, improved accommodation.

The current unit market climate for landlords however is clearly challenging and set to worsen with government support initiatives now winding down and the looming end to the mortgage-relief recently provided by banks.

And there is certainly no prospect of a sharp improvement in demand anytime soon that will push vacancy rates downwards and offset falling rents – particularly with international borders remaining closed and the spectre of ongoing local lockdowns.

Forced to sell

Although the current buyer market for inner suburban units in Melbourne and Sydney generally remains stable, driven by solid owner-occupier demand – downsizers, empty nesters and first home buyers – this may change rapidly if, as likely, landlords increasingly struggle to meet their outgoings and are forced to sell in significant numbers.

Signs of this are already clearly emerging in key inner-city markets. The median asking price for units in the City of Melbourne has fallen by 4.9% over the past year, down to $470,000 with Docklands down 20.2% ($550,000) and Melbourne CBD down 5.7% ($452,500). The number of units in the City of Melbourne currently for sale has increased sharply over the past year with well over 1000 now seeking a buyer.

Sydney inner-suburban region unit prices are also now falling with the City and East down 10% over the past year to $845,000 and the Inner West falling by 6.3% to $680,000. Sydney CBD unit prices have fallen sharply over the past year down by 22.7% to $1,050,000.

The number of units currently for sale in the Sydney CBD has increased by 32.7% over the past year with the Inner West higher by 8.6% – however current unit listings in the City and East are down by 2.0%.

“More tough times ahead are likely for inner-city unit landlords in Melbourne and Sydney – but better news for renters and buyers,” says Dr Wilson.

If you want to start a discussion or ask a question about this, log into the Flat Chat Forum (using the Forum link on the menu at the very top of your screen). More people will read it there and you can more easily keep track of responses.